In a few hours on May 3, the bitcoin price increased from $ 5,300 to $ 5,700 in major markets, allowing the crypto market to earn more than $ 7 billion a day.

Ölçü Most crypto assets in the global market have increased dramatically last week. “

Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH) and the main crypto assets, such as EOS, increased by 4 to 8% against the US dollar, boosting the momentum of the crypto market.

Bitcoin's Rise Is Very Attractive

The sudden rebound in the crypto market ahead of the strong price move in bitcoin prices was largely unexpected due to controversy surrounding iFinex, the company that controls the operations of Tether and Bitfinex.

On April 25, New York Attorney General (NYAG) Letitia James said that the loss of Bitfinex from Tether's cash reserve amounted to $ 850 million. "Hide" he filed a lawsuit against iFinex, claiming to have spent 900 million dollars.

NYAG's office reported that Bitfinex sent $ 850 million in a Panama bank, which Crypto Capital Corp. claims to have provided banking services to various crypto exchanges that are struggling to attract services from large financial institutions. a "Bank" he said he sent.

As a result, Bitfinex has failed to compensate $ 850 million, which is probably the company's $ 900 million loan from Tether.

The official document, which was published by the NYAG office and emphasized that the agreement between Bitfinex and Tether was not disclosed to users and investors, explained:

Ler According to the statements, Bitfinex has already received at least $ 700 million from Tether's reserves. These transactions see Tether's cash reserves as Bitfinex's corporate bribe fund, and are used to conceal Bitfinex's large, unexplained harms and inadequate customer retreats. "

Nevertheless, despite the troublesome developments in the iFinex-Bitfinex case, the bitcoin price increased from $ 5,135 to $ 5,735 as of the last week.

What triggered the Bitcoin Rise?

In an exclusive interview, cryptocurrency Crypto Rand, unit processor and technical analyst, said that the upward movement of bitcoin and the rest of the market could only be technically seen.

According to the analyst, during the last two weeks, technical indicators pointed to the upward momentum for bitcoin. As the market is recovering very quickly from the Tether scandal, it is likely that existing investors will increase their confidence in the market.

Yok There is no basic reason behind me. The Tether status caused no improvement in time. Even this, however, the lift range stopped in the channel support and did not cause major damage to the main volume. My point of view is clear. All relays on TA. It seemed to be going up for more than two weeks. İki

the #Bitco it looks like it will keep its place on the hashtag and it can even find $ 6,000.

Stuart Hoegner, general adviser to Tether and Bitfinex, said Stuart Hoegner, the CEO of New York State Yoni Assia, CEO of eToro, could act as a catalyst for the upcoming bitcoin rally.

Mı Should the news be to pump or toss BTC? The bad news is that if $ 2 billion USDT is replaced by BTC, it actually raises the price. The Tether Advocate Now Adopts Stablecoin 74% Supported by Cash and Equivalent, uk Assia said.

As the owners of Tether began to sell stabilcoin for bitcoin, they might have requested the asset request on paper. The fact that traders can keep their funds in bitcoin or buy bitcoins to sell for fiat can cause the asset to gain momentum.

Can Bitcoin Preserve Its Current Acceleration?

Some leading investors in the crypto area, such as Vinny Lingham from Multicoin Capital, said bitcoin, which is in the range of $ 6,200 to $ 6,400, would formally mark the start of a new bull market. Lingham said:

In The most important indicator of the start of a sustainable bull race is the separation of asset values from Bitcoin (for example, the power of Bitcoin weakens other networks or vice versa). Another thing is just speculation again (maybe we need another bubble to learn more lessons?

If we break $ 6,200 for BTC, it would point to the beginning of another large bull increase and could lead to a rapid increase, but if pure speculation and other assets are disproportionately beneficial to the created value, it's probably not going to end, kır he said.

Dol The valuation of the crypto market rose to $ 185 billion a night, adding $ 7 billion. “

However, some traders in the crypto-currency sector pay attention to the short-term trend of the asset due to both technical and key factors.

For example, DonAlt, a crypto-currency technical analyst, said the Bitfinex premium is a lack of stability, which could potentially cause the market presence to fall below $ 5,000.

Crypto Rand said that bitcoin was facing a strong resistance and the resistance could take a few months to be overcome, suggesting that in the short term the entity could try to leave the $ 6,000 zone:

Iz Right now, we're probably facing the strongest horizontal resistance on the entire Bitcoin chart. I don't think it's going to be easy, but I'm sure of a break in the coming months; Another bull race is a breakout. An indicator I've been following closely to track the status of BTC's market capitalization is currently showing a $ 100 billion mark or a net momentum after the first time in 2019. "

Acceleration continues since December

In recent months, bitcoin has been largely dependent on technical factors to record momentum and reverse movements.

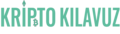

The highly anticipated block prize half expected in May 2020 is considered to be a strong basic factor that can serve as a solid catalyst for the medium-term price trend.

However, in the first half of the year, most of the bitcoin's 3,150 to 5,700 bitcoin gains, with an increase in the volume of the bitcoin futures market of $ 5,000 CME from $ 4,200 in the first week of April. Mati Greenspan, a senior analyst at EToro, said in his interview:

Görünüyor The crypto market has gained much speed since the lowest level in the middle of December, and many traders seem to be on the rise. The April 2 fluctuation saved us from some important obstacles and we're pushing further this morning. "

In the foreseeable future, although some traders have expressed concern over the Tether debate, Greenspan said that if investors leave the Tether market, investors will start buying bitcoins and will further increase the asset's demand.

Daha Any reliance on wear is much more likely to send Bitcoin than downstream. At present, Tether has a volume of approximately $ 2.8 billion. If investors leave him, they will probably only get Bitcoin. "

In the last few days, the 10 real 10 olan bitcoin volume, which is the daily bitcoin legal spot volume calculated using the methodology offered by Bitwise Asset Management, increased to approximately $ 900 million, based on the data provided by OnChainFX.

In March, Bitwise Asset Management calculated the ”real 10“ volume at $ 270 million. Bitcoin volume increased by more than 200% in less than a month compared to early March.

To be the first to be informed of the most important crypto money news and price analysis: You can follow us at Telegram!

Warning: The opinion expressed here is not investment advice - only for informational purposes. Each investment and trading involves a risk, so you should always do your own research before making a decision. We do not recommend you to deposit money that you cannot afford to lose.

Analysis5 years ago

Analysis5 years ago

Industry News5 years ago

Industry News5 years ago

Blockchain News5 years ago

Blockchain News5 years ago

Guide5 years ago

Guide5 years ago

Bitcoin Guides5 years ago

Bitcoin Guides5 years ago

Analysis5 years ago

Analysis5 years ago

Guide5 years ago

Guide5 years ago

Guide5 years ago

Guide5 years ago